Customer Acquisition Cost (CAC) – A Management Concept Worth Knowing

We used to measure the number of views, exposures, clicks, likes, coverage, ratings, copies, time, phone calls, inquiries, repetitions, length, size, location, scope, etc., which are all important quantitative data without a doubt but…

Marketing is no longer a quantitative process

Since then, we’ve found out that what really matters is the quality of the leads – the quality of marketing and advertising, the quality of engagement and exposure.

It’s become more important to us to define ‘who’ and ‘what’, or ‘when’ and ‘why’ rather than ‘how much’ and ‘for how much.’

For quite some time now, it’s been necessary to define and manage a high-quality customer journey and an effective marketing funnel. The quantitative definition is no longer relevant and is insufficient.

The same is true for the number of customers, new or existing.

It’s true that according to the law of large numbers – the more customers you have, the more likely you are to sell.

And no doubt that more customers equal more sales opportunities, and probably more revenue.

But will we necessarily earn more?

The question is, what do we need to invest, and how much, in order to reach all these customers, and then, how much does it cost us to retain them. And finally, how much money do these customers really make us?

Customer Acquisition Cost

What is customer journey (CJ) what is the customer lifetime value (CLV), and how are they intertwined?

The customer’s journey

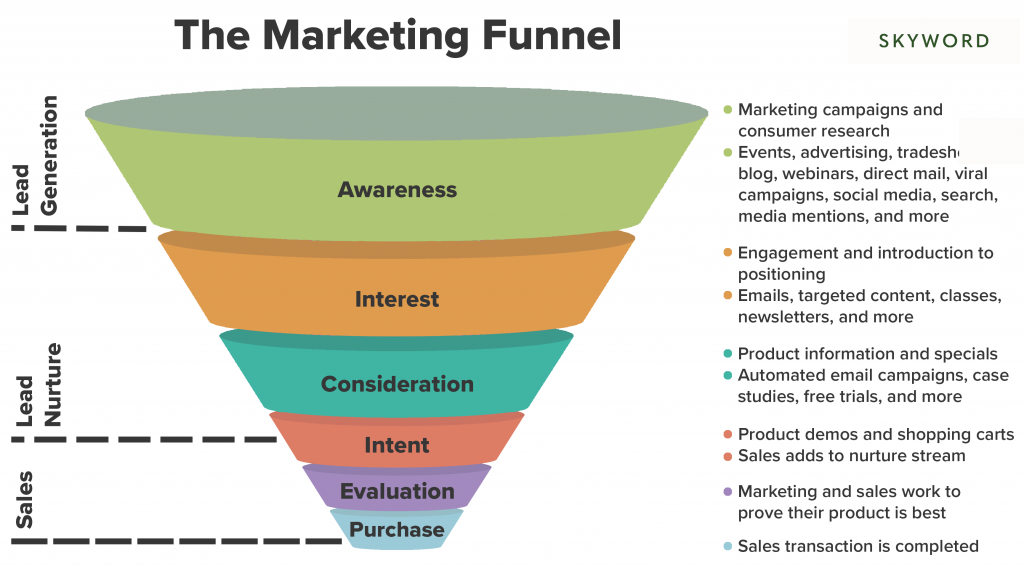

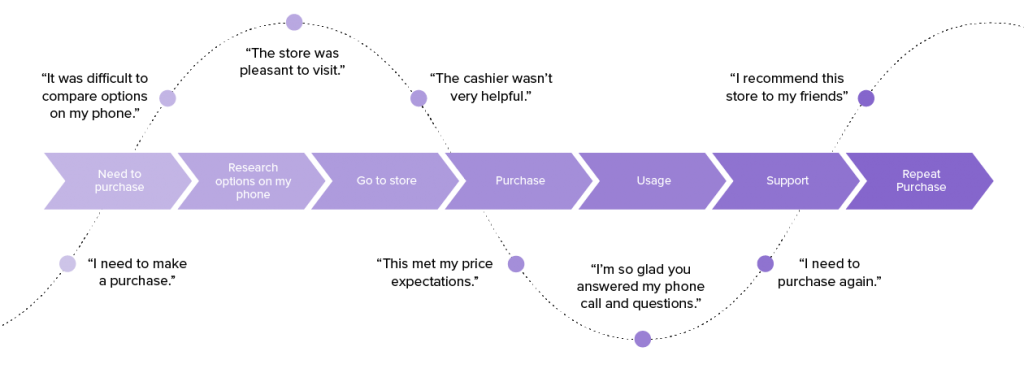

Under customer management processes, the terms Customer Journey (CJ) and Customer Touch Points (CTP) are the various stations that the customer goes through, from the moment it is defined as a “potential” prospect, to its definition as “new” and even “existing” or “returning” customer. On the marketing management side, this is called a marketing funnel or a sales journey.

An example of such journey can start at the moment that a need or a desire is created; The moment a person is exposed to the product or service (creating awareness); the moment they research the competition and compare between your offerings and theirs; the phase where you offer the interested customer an added value; the timing of the creation of preference and choice, and the decision making; the sale or order stage, and so on till you reach the actual product delivery or installation stage, which has to do with the service the customer receives, and whether they make a complementary sale or a repurchase.

Below is an example of a retail customer journey:

In most of these stations, we are able to control and manage the processes, we can be present or we can target buyers. In some of the stages, however, we are passive and lack real control, and can only wish to be influential once more.

A customer journey is primarily experiential (for better or worse), and its whole essence is subjective and seen through the eyes of the customer. As such, managing it so that it is a quality and efficient journey that satisfies the customer, requires resources and costs the company money.

The client’s lifetime value

Client Lifetime Value (CLV) is the value of each customer, new or existing, throughout the entire period of the relationship with your business. CLV is the amount of revenue or income yielded from an average or a specific customer.

For example, we can examine how much did they buy during their first purchase, how much money did they spend during their repurchase process, how much money do they spend throughout the year, their significant impact on the purchases of others, did they invest in spare parts or repairs, and how much did they pay for deliveries and insurance.

The greater this average value, the more efficient and profitable the marketing and customer management.

Here too, just like in the customer journey – we are in control most of the time, being able to initiate or manage the process, but in some cases, we are passive, out of control and knowledge, and can only wish for things to go our way.

The customer’s lifetime value depends not only on the customer but first and foremost on us: on our product, our service, our availability, our marketing tactics, our sales, our preservation attempts, and the experience we give our customers. A satisfied customer doesn’t require a lot of resources and mostly puts money into the company.

One costs money and the other yields money

Marketing is no longer a quantitative process. Customer Acquisition Cost is a quantitative index that measures, tracks, and evaluates the quality of our leads.

Both journeys depend on both the company’s capabilities and the customer’s will and behavior.

One journey costs money (expenditure), and one journey yields money (income). And this is how they are intertwined: the quality of the customer journey affects the quality and value of the customer, and quality and accurate customer journey yield quality and productive customer’s lifetime value.

We’ve yet to say a word about quantities and numbers but rather, have focused primarily on value and quality.

What is Customer Acquisition Cost (CAC)?

The way we measure quality

We need a quantitative index in order to measure, track and evaluate quality.

One of the most well-known KPIs and important metrics, which examines a lead’s quality as well as a customer’s quality and value is the Customer Acquisition Cost (CAC)

This is basically the monetary cost required to recruit one new customer. The smaller the CAC’s average cost, the more efficient the marketing, acquisition, and customer management is.

The goal, bottom line, of any business, organization, and company, unless it’s a nonprofit, is to make money. The CAC index allows you to calculate your Return On Investment (ROI), by calculating the ratio between the cost of acquiring a new customer (CAC), and the economic value it provides to the company, in revenue and profitability, throughout the customer’s lifetime (CLV).

If the value given by the customer is lower than the customer’s purchase cost, you should be wary of the quality of the acquisition (the marketing, advertising, and sales processes) and the quality of the leads, customers, sales, and their profitability.

Now that we are familiar with the terms above, we can define in other words – the higher the resources invested in the marketing and sales funnel, in customer management, and in the customer journey, required to acquire the life value of a particular customer, the lesser the quality of the customer journey.

A good and high-quality customer journey is supposed to run smoothly and effortlessly across the different stages. This does not necessarily mean that you should invest less money in the management process, or in the customer journey but rather means you should optimize and maximize them, refining your potential targeting and segmentation, and improving conversion, sales, and purchasing ratios.

Understanding CAC through consumer’s side values

The CAC index, which is equivalent to an index from the consumer’s side (an index that is accepted in purchasing calculations), is called the Total Cost of Ownership (TCO), i.e, the total cost of purchase, total service, or product ownership, over the entire product/service life. In other words: a product/service/supplier procurement index.

The initial investment is of course in the purchase itself or the order made. It can be the cost of a specific product/service – for example, printer, car, software, camera, legal services – be it a one-time cost, a payment in installments, a retainer, or a subscription.

But it is very important to weigh the other expected and cumulative future expenses: repairs or maintenance, upgrades or additions required, consumables or spare parts, service, emergency or care/emergency payments, support, training and advice, insurance, and more.

Isn’t it true that when you think about it this way, then suddenly the price is completely different?

What does the CAC include?

CAC includes the total costs invested directly in your customers and that are allocated in order to find out their preferences and create satisfaction.

This means your branding and PR; marketing and advertising; sales; maintenance of a point of sale or trade site; service; customer retention; customer management; operation (installation, maintenance, training); technology and equipment related to your marketing and operational activities (for example distribution and shipping logistics, clearing, CRM, etc.)

The cost does not include what is related to the product/service and elements that don’t depend on the customer or affect the marketing and sales process, such as purchase credit; supplier management; production; development; imports of goods; taxation; insurance; wholesale; general management; rents, etc.

The customer acquisition index is subjective and flexible. It is determined by the definition of revenue or a profit level that each organization seeks to generate from one customer unit (what is sometimes defined in the pricing world as Cost +).

CAC can vary from domain to domain, from manager to manager, from period to period, from one PnL to another.

When calculating the index, it is mandatory to consider and weigh the amount of income (or profit) expected from the customer throughout the entire customer lifetime (the CLV), and not in reference to one purchase or their first purchase.

Micro acquisition cost metrics

Marketing customer acquisition

Similar to the cost of acquiring a customer, a complementary index worth focusing on is the marketing acquisition cost. This index includes the total marketing inputs – or the total investments and marketing expenses associated with the purpose of recruiting new customers in relation to the number of sales.

How much, then, does a new customer actually cost us, in terms of marketing?

In order to reduce and improve the cost of marketing acquisition, it is possible and worthwhile to reduce the cost of marketing or reduce the budget directed and intended for marketing channels and customer campaign management. I’m talking about promotion fees, advertising fees, referral payments, PPC, media, content, research, branding, etc.

On the other hand, or simultaneously, it is also possible and worthwhile to improve and increase the conversion ratio (purchases).

The lower the cost of marketing acquisition i.e. marketing expenses, in relation to the sales volume, the higher the organization’s profit.

From a marketing standpoint, the main goal is to consistently improve processes so that the cost goes down, without harming the level of sales and revenue. It is easy to increase the marketing budget to increase sales, but it is much harder to reduce the budget and become more efficient, without reducing sales and certainly when it is necessary to increase them.

Any sale that is directly attributed to marketing processes should be defined in the measurement

Conversion from a campaign, sales due to a promotion on the site, increasing product sales at a certain point of sale, sales following a campaign, etc.

In companies that have built-in follow-on sales processes (such as services or complementary products, insurance, training, maintenance, spare parts, model upgrades, license additions, etc.), which are known as upsells – even when not directly related to a particular marketing process -It is customary and correct to also attach these follow-up sales data to the calculation of the cost of the marketing acquisition. They are part of the customer value and the sales relationship, and a future derivative of the current marketing processes.

Sales customer acquisition

In terms of sales, in addition to the marketing cost of the acquisition, it is also possible to examine the cost of a sales customer acquisition. That is, how much does it cost us in terms of sales resources and budgets, to acquire a new customer.

The cost includes, for example, the direct and indirect sales efforts such as staff salaries, target benefits, bonus commissions for employees, sales promotions, volume discounts, benefits, samples, promotional stewards, and other elements that are within sales management, but not within marketing and advertising management.

Also, in this case, the lower the cost of the sales purchase, in relation to the number of closed deals and orders – the higher the quality of the index and the more profitable the organization.

It is worth emphasizing that sometimes the cost of marketing investment is greater than that of sales, and sometimes the investment in sales exceeds the marketing expenditure – so these indices are not comparable to one another. Also, there are companies, where marketing and sales are managed together and then these metrics are inseparable.

But in most companies, where customer acquisition costs are measured, the cost of marketing acquisition is measured separately, with the company every so often taking a closer look at the cost of sales acquisition data. Moreover, it is also possible to manage value and cost calculations for service, retention, and even resolutions such as purchasing a customer digitally or purchasing a customer from a point of sale.

Both macro and micro customer acquisition metrics are equally vital

It is clear that the cost of general customer acquisition (macro) will always be higher than the cost of a marketing or sales acquisition (micro).

At the same time, it is correct to examine both indices, and not be satisfied merely with the general index or the marketing index. This will help you get the most insights about the meaning of the business and marketing efficiency relationship, the way they work together and separately, and help you set goals for improvement.

For example, the organization may not be earning enough money, and the customer value index versus the cost of its acquisition is negative. In order to know if and where the gaps are we must first examine both metrics to find out where accuracy and optimization are required.

Do we need to improve customer value (sales and retention), or customer journey management (management, operations, marketing, service)? Once we’ve answered those questions we can streamline the marketing, and/or sales, and even operational procurement process with more accurate and in-depth resolutions.

Measuring solely marketing acquisition metrics will not give us the full picture, even if it is the most significant and available for management and improvement.

The importance of Marketing Customer Acquisition for Marketers and Advertisers

The marketing acquisition cost index is essential for marketers and advertisers who are required to monitor marketing expenses, especially in companies that work with digital promoters and advertisers (lead providers) or with media purchasing companies that price exposures and ratings.

In light of the transition to quality indices (customer acquisition and quality), the accepted advertising indices for payment to suppliers have also changed. Today, the amount of impressions, likes, clicks, and leads, or the number of leads converted properly isn’t monitored as much, but rather the actual marketing acquisition costs of new customers are measured, and on the basis of these goals a payment is set.

Even at the internal organizational level, it is right to set purchasing goals and reward efficiency and quality rather than quantity.

Let’s sum it up

These are very applicable metrics

Customer acquisition cost and the micro-marketing and sales customer cost metrics will make it easier for you to get answers to pricing questions, to definitions, and decisions on the scope of marketing and advertising budgets (including whether to increase or decrease them), to the question of how to find balance points and return on investment, to help set marketing and sales goals, to help set customer management metrics, as well as to help make service and retention decisions.

They can also help you decide whether to provide a benefit, whether the customer is worthwhile preserving, whether they’re profitable, etc. Therefore, they make excellent tools for creating an increase in revenue and profitability, along with streamlining the CRM processes.

They make it possible to choose between improving and streamlining existing and internal customer journey stations (customer management and retention, operations, earnings per share), and improving external array stations (marketing and/or sales) as well as helping you decide which of the stations will contribute more and improve the indices (being faster or easier).

The indices are management tools. Financial, qualitative tools and not just marketing and sales tools. As such, they are intended to be part of the metrics and targets set by your management team and are derived not just by the marketing, sales, and retention departments, but also for service and operations, procurement, and supplier management.

One more thing.

Practice makes perfect. Don’t forget to download my exercise with two examples of what and how to measure general customer acquisition cost and marketing customer acquisition cost.

PPC Marketing Expert?

Get things done with Adcore Marketing Cloud.

5 essential PPC tools under one roof.

Related Articles